Fenics Market Data Inflation Offerings

Wed, 22 Jun 2022 3:17 pm

Would you walk a tightrope blindfolded?

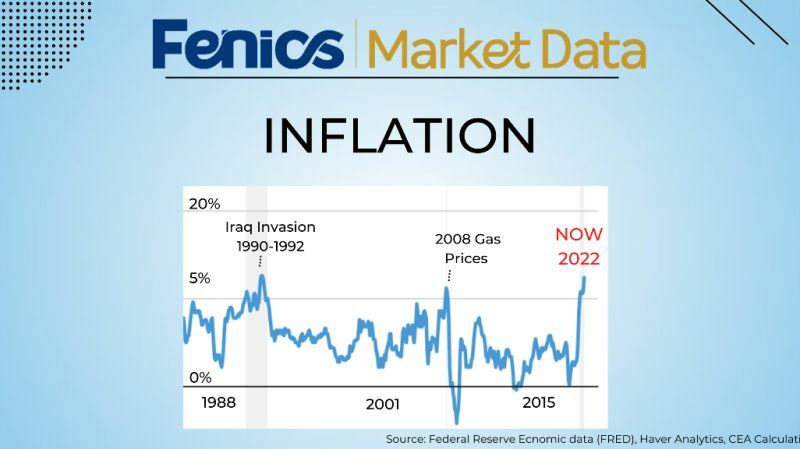

Increased uncertainty and a downward strain on market participants with inflation linked liabilities seem to grow by the day. The inflation-swap market has seen renewed interest as investors seek long-term protection against inflation with the total notional amount traded and number of trades reported to DTCC’s swap-data repository increasing almost 40% in 2021. Given the re-emergence of inflation volatility globally, trading in these instruments has also increased in 2022 and is expected to continue to grow.

BGC Partners & GFI Group inter-dealer brokerage desks, combined, equate for over 70% of the IDB market share for zero-coupon inflation swaps and are market leaders in many other inflation-linked assets. Fenics Market Data are uniquely placed to be able to offer these rare and sought-after datasets to help our clients mitigate the effects of rising inflation.

For further details, contact your Fenics Market Data salesperson or email us at [email protected].

#FenicsMarketData #Data #BGC #GFI #CPI #CPIfixings #Inflation

FENICS MARKET DATA

© 2024 BGC Group, Inc. BGC is a registered trademark of BGC Group, Inc. or its affiliates in the U.S. and/or other countries. Fenics and Fenics.com are trademarks/service marks or registered trademarks service marks of Fenics Software Inc. or its affiliates in the U.S. and/or other countries. GFI is a registered trademark of GFI Group Inc. or its affiliates in the U.S. and/or other countries. MINT is a registered trademark of BGC Brokers LP or its affiliates in the U.S. and/or other countries. Remate is a trademark of Remate Lince, S.A.P.I. de C.V.(Mexico) or its affiliates in the U.S. and/or other countries. BGC Liquidez is a trademark of BGC Partners, L.P. or its affiliates in the U.S. and/or other countries. Entities within the BGC Group, Inc. group are registered as applicable. For regulatory disclosures and disclaimers please visit: www.bgcpartners.com/bgc/global-businesses/